|

Obviously, the biggest concern for all of us in our country right now is containing the spread of COVID-19 by #flatteningthecurve of the spread of the virus. Now is the time to take aggressive action to protect our healthcare system and save lives. If you are not yet fully informed on the importance of this effort, this excellent article provides compelling data. However, another huge concern is the economic impact on our world. For those of us in non-profits arts organizations, we are most concerned about the financial health of our individual artists. Skylark is made up of some of the finest ensemble musicians in the nation. Our artists are at the absolute top of their field. Many have multiple degrees in music. They are in demand on concert stages and in recording studios across the nation. They have been nominated for multiple GRAMMY Awards. What does COVID-19 mean for artists like this? In short, it is financially devastating. To understand this, let’s look at the career of a hypothetical highly successful freelance musician who earns her living on the concert stage. Let’s call her Emma. Here are a few things to understand about our hypothetical classical music rockstar:

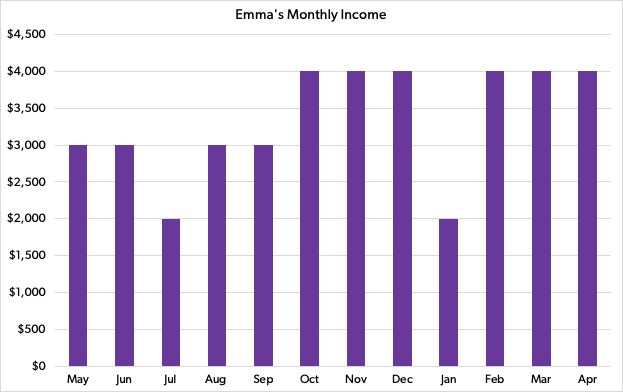

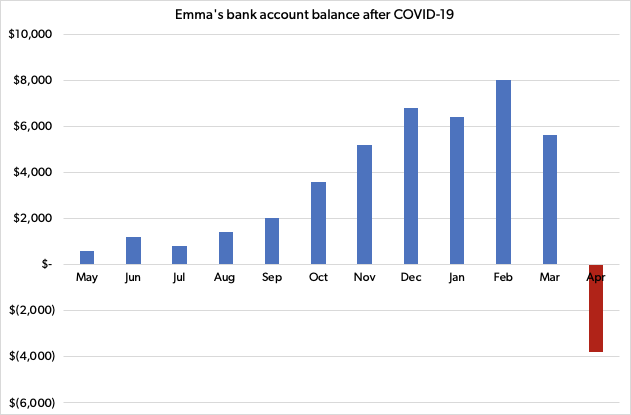

How does Emma do financially? Emma is one of the best in the country at what she does She keeps herself busy most of the year, and as able to make $40,000 over 12 months in her career as performer. This is very good. Her income in a typical year looks kind of like this, considering a 12-month period from May-April (April is last, because, well, taxes!) You probably noticed that Emma’s income is higher during the traditional music “Season” in the fall and Spring. There are fewer concerts in the summer and the ‘shoulder’ seasons, so her income is lower in those months. What do her expenses look like?

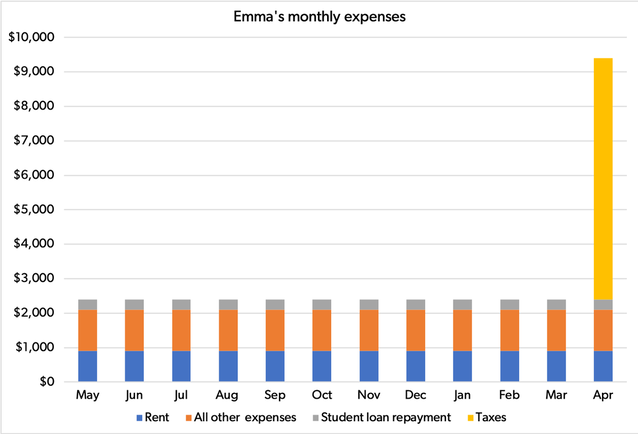

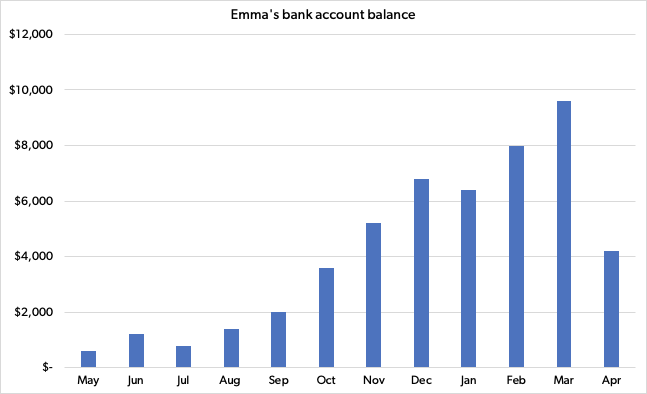

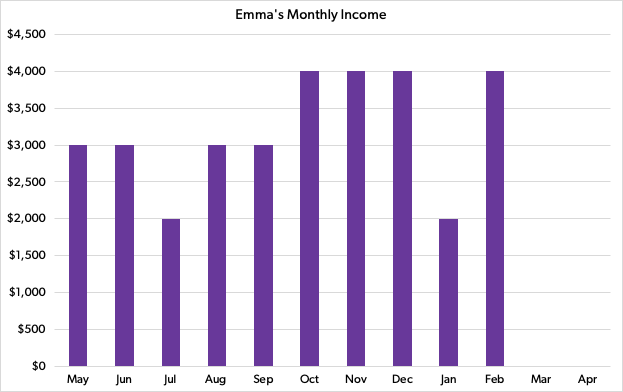

Here are Emma’s expenses by month: What does her financial plan look like for the year? Emma plans to SAVE 10% of her income this year, to start to build a nest-egg for her future. Here’s what she expects her bank account to look like at the end of each month based on her contracted work. Last week, Emma was very excited that she would meet her goal of saving over $4000 over 12 months. What does COVID-19 mean? This week, Emma has found out that all of her paid work for March and April has been cancelled, because each one of the arts organizations that hires her has been forced to cancel all public events. Even though the arts organizations have Emma’s best interest in mind, they unfortunately don’t have the money to pay her, because the ticket sales and concert fees will never materialize. What does Emma’s situation look like now? Here’s her income: Here are her expenses: Note, her tax bill hasn’t changed despite her lost income, because it only applied to January to December of the previous calendar year. How about her bank account balance? So, in the space of 5 days, a highly financially responsible professional has gone from a path of saving 10% of her income to having no way to support herself over the next few months.

This is an absolutely terrifying situation. Of course, we hope for government action to help people like Emma (and countless other hourly workers or people in the gig economy, who have similarly scary situations). However, this support is not likely to come fast enough. What can we all do now? Think about performing arts organizations that are near and dear to you: choral ensembles, orchestras, string quartets, opera companies, theatre companies. Think about all of the people whose courage in pursuing a life in the arts makes great performances possible. Go to their website and donate today - it could make a huge difference in the life of artists like Emma. - Matthew Guard, Artistic Director, Skylark

10 Comments

3/13/2020 08:33:42 pm

Matthew, thank you for your thoughtful and well-written article. Indeed, those who earn a substantial portion of income through self-employment face challenging times. One minor suggestion: regardless of courage, pay quarterly income taxes, even if uncertain of the correct amount. Under payment in advance beats no payment in advance, as it minimizes interest and penalties— monies which can be put to better use. With every good wish, GG

Reply

Bonnie

3/14/2020 08:41:02 am

If Emma paid quarterly taxes, she would still be in the red at the end of this. Just saying. Helpful hints are a little bit like thoughts and prayers.

Reply

Margot Rood

3/15/2020 08:02:52 am

Hi, Gary. Unfortunately it isn't so easy---sometimes living expenses are more immediate than quarterly taxes: rent hikes, unexpected medical bills not covered by insurance, and, specifically for singers, losing gig income due to something as simple as the common cold (when you're sick it is often not possible to complete a vocal contract, therefore more income is lost and unable to be put toward quarterly taxes). Of course, we all should endeavor to pay them quarterly but it just isn't always possible every three months.

Reply

3/14/2020 04:11:35 pm

Emma and many others like her, will be in better shape if we 1. do not ask for refunds on tickets 2. are able to donate to or join arts organizations now 3. ask our representatives to remember the arts now and offer them unemployment compensation. Many, many people are going to need help.

Reply

Ann

3/15/2020 04:06:52 am

This is spot on... thank you for pulling the curtain back to view a freelance musician's reality. It is a very scary time. Yes, we must care for each other like never before.

Reply

3/16/2020 10:32:48 am

A forgotten population- let’s find a solution for this dilemma!

Reply

3/1/2021 03:04:38 am

The other best thing Emma can to do is to host virtual concerts through online and make money for her living.

Reply

Cathy D.

5/8/2023 04:50:28 pm

COVID was rough as an independent contractor musician. It was also surreal afterwards getting back into sending out information returns once gigs started happening again. I know some people who still struggle with the paperwork and recommend them looking into tax software: https://1099-etc.com/. The right software allows you to e-file your year-end 1099 forms to the IRS.

Reply

5/10/2024 06:55:57 pm

I've tried this software before and it was a massive time-saver. It's a huge help that is also provides easy form alignment. You would not believe how much time I used to spend making forms look the way they should during tax season.

Reply

Leave a Reply. |

AuthorMatthew Guard Archives

April 2020

Categories |

©2023, Skylark Vocal Ensemble Inc.

8735 Dunwoody Place, STE R, Atlanta, GA 30350

617-245-4958

8735 Dunwoody Place, STE R, Atlanta, GA 30350

617-245-4958

RSS Feed

RSS Feed